Economic uncertainty weighs on the residential market

The most recent UK Housing Market Update from Savills has highlighted that buyers’ budgets continue to be impacted by higher mortgage rates, and although inflation has begun to move lower, core inflation remains ‘unexpectedly sticky.’

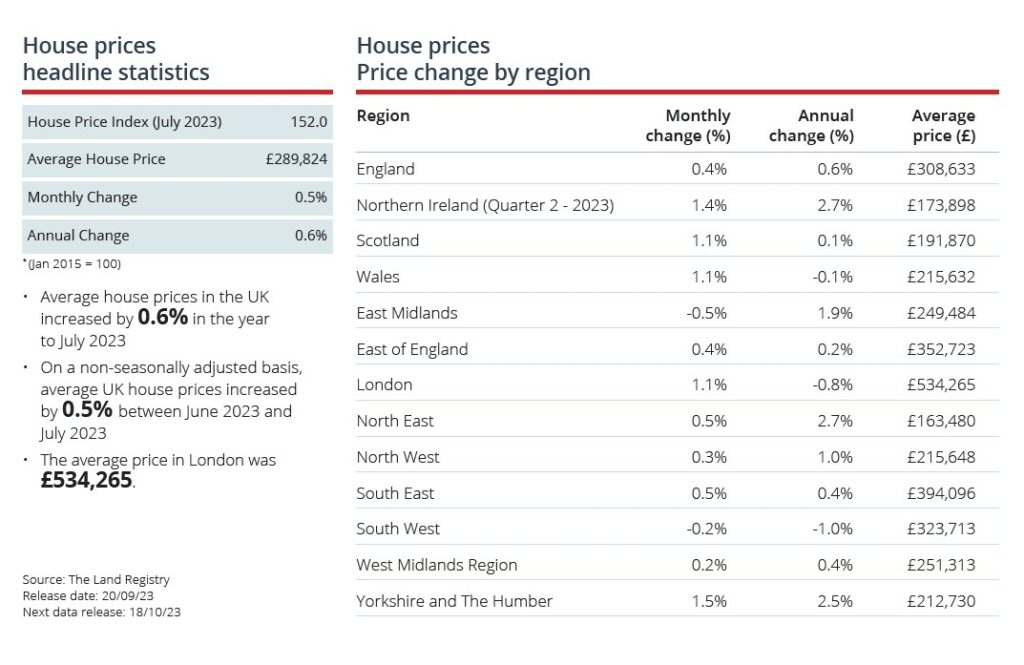

During July, with completed sales reducing by 18% on the 2017-19 average, market activity was notably subdued, according to HM Revenue & Customs (HMRC) data. Accordingly, during the three-month period to July, mortgage approvals were 23% below 2017-19 levels and sales agreed were 12% below the average (2017-19 levels).

In its report, Savills referred to the most recent Royal Institution of Chartered Surveyors (RICS) survey, in which most surveyors reported decreasing demand and supply, which is likely to continue suppressing activity and house prices over the coming months.

Looking at UK annual rental growth, Hamptons Lettings index has shown that the cost of renting a new property was 12% higher in August compared to the previous year. The biggest increase was in Greater London, rising by 17.1% year-on-year to bring the average to £2,332 per month. After that comes Scotland, with an increase of 13.4%.

Improved EPC ratings see green price premium

Research by Rightmove has found that 78% of homeowners would be motivated to make changes if their energy bills reduced. The higher a home’s energy performance certificate (EPC) rating is, the lower the property’s energy bills are likely to be.

The analysis of 300,000 properties that have sold twice in the last 15 years, and have had a new EPC certificate issued, shows there is an additional green premium on top of local house price growth over time.

A home with an EPC rating improving from D to C could see an average increase in value of 3%, or £11,157. While moving from an F to a C rating could increase the property’s value by an average of 15%, or almost £56,000, when looking at the current national average asking price.

The highest yielding areas for buy-to-let property

The average gross rental yield in the UK is currently 5.03%, based on an average buy-to-let property costing £263,000 and an average rental of £1,163 per month, according to Zoopla’s September Rental Market Report.

The region with the highest rental yields is the North East, where the average gross yield is 7.2%. The North East’s yield appeal is largely thanks to the investment triangle of Hartlepool, Sunderland, and Middlesborough where gross yields sit between 8.01% and 8.39%. Following the North East is Scotland (7.1%) and the North West (6.3%).

The highest yielding cities in the UK are Sunderland, Dundee and Burnley, which offer a gross yield of between 7.7% and 8.4%. London has the lowest gross yield (4.7%) in the UK owing to the cost of buying a property there. This is despite average rents in London reaching £2,053 this month.

All details are correct at the time of writing (20 September 2023)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.